Auto Owners

Frequent Asked Questions

What is Auto Insurance Reform?

Effective with July 2, 2020, the Michigan no-fault landscape has changed. The most impactful change is the named insureds/applicants will no longer be required to purchase unlimited no-fault (PIP) benefits. It now allows the opportunity to choose from an option of limits of Personal Injury Protection (PIP) benefits.

Other changes to Auto Insurance are:

-

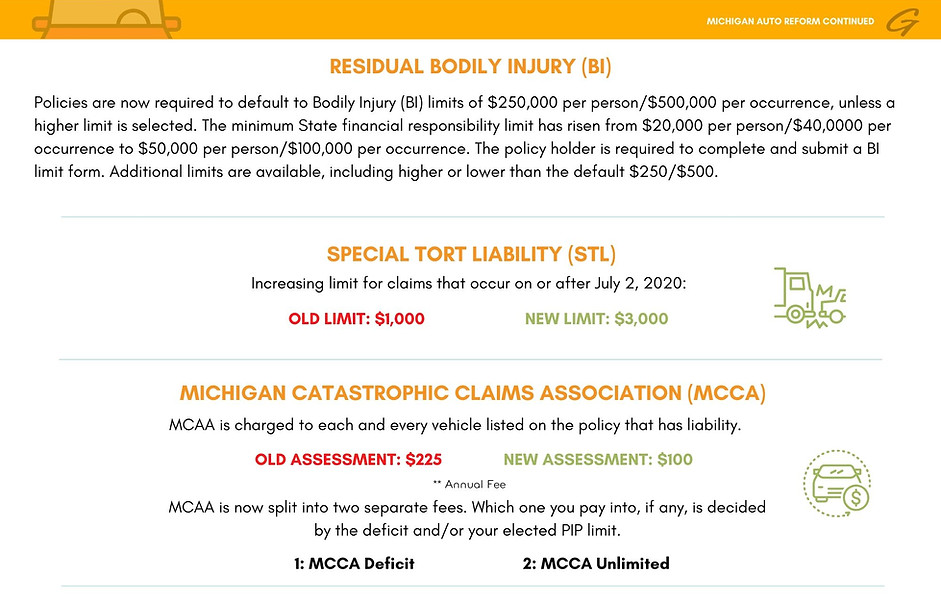

New Bodily Injury (BI) Liability limit minimums and a default limit

-

MCCA Fee has decreased from $225 per vehicle to $100 per vehicle for policies that have chosen the unlimited PIP option. All other choices currently result in a $0 MCCA Fee.

-

Mini-Tort maximum has increased from $1,000 to $3,000

Other changes have been implemented but are more so on how coverage is applied in the event of an accident. A conversation with one of our agents is best to discuss the these applications.

What do I have to do now?

The most important action is having a conversation with one of our agents. Household scenarios differ greatly and therefore individual decisions need to be discussed.

You will receive Selection Forms. All policy holders are going to be required to respond to and complete two (2) forms:

-

Personal Injury Protection (PIP) Selection Form

-

Bodily Injury Liability (BI) Selection Form

Completing these forms without guidance can have a large impact on future coverage and therefore it is recommended to complete these forms with the guidance of an agent. Not responding to these forms will result in policies being set to the state default limits of Unlimited for PIP and $250,000/$500,000 for BI. These forms are being mailed to policy holders 90 days prior to their renewal.

Make an appointment to discuss your options.

Will it save me money?

The exact premium situation is going to vary depending on each individual scenario. Though, generally, insureds should see premium savings on their new Auto Reform policies. Primarily because the MCCA fee is decreasing from $225 per vehicle to $100 per vehicle for unlimited PIP selections. It is decreasing from $225 per vehicle to $0 per vehicle for all other PIP selections.

Example 1: A three (3) vehicle policy that selects unlimited PIP will save $375 per year.

Example 2: A three (3) vehicle policy that selects anything other than unlimited will save $675 per year.

Other savings that are guaranteed are PIP reductions. The reductions are as follows and are guaranteed for a period of eight (8) years.

-

Unlimited - 10% reduction

-

$500,000 - 20% reduction

-

$250,000 - 35% reduction

-

$50,000 - 45% reduction

-

Excluded - 100% reduction

* These reductions are on the PIP line only

Where savings might be minimal is when you currently have a low Bodily Injury (BI) limit and need to raise it to meet the new state minimum limit or you select a limit higher than the state minimum limit.

I have health insurance, do I need PIP?

With the new PIP selection options an option you have is to choose your Qualified Health Coverage over PIP. A Qualified Health Coverage includes a policy that does not exclude or limit auto accidents and does not have an annual deductible over $6,000. In some scenarios Medicare Parts A + B qualifies for a Qualified Health Coverage.

Although health insurance is an option over PIP it is highly recommend to discuss this with your agent. Even the strongest of health plans to not match the coverage provided by PIP. It is crucial to discuss the difference in Health Coverage vs PIP with one of our agents. Here is a side by side comparison:

The information provide is what has been released to this point. Final details are subject to change and we are following these each day. It is is of the utmost importance you meet with an agent from Gauthier Insurance to review your Auto Reform options. Not understanding your options could have lasting consequences in the event of a claim.